How much did that Montana home sell for?

Here in Kalispell Montana, sellers and buyers have been known to use the price they see online as a sale price. For example they might say, “Well the house down the street sold for $1M, let’s price it at that!” Here is why, in the state of Montana, using that information just doesn’t work.

Montana is one of twelve “non-disclosure” states in the country. That means that actual sale prices for homes are not disclosed in public databases or websites. It also means real estate professionals cannot share sales price information on their own websites or blogs.

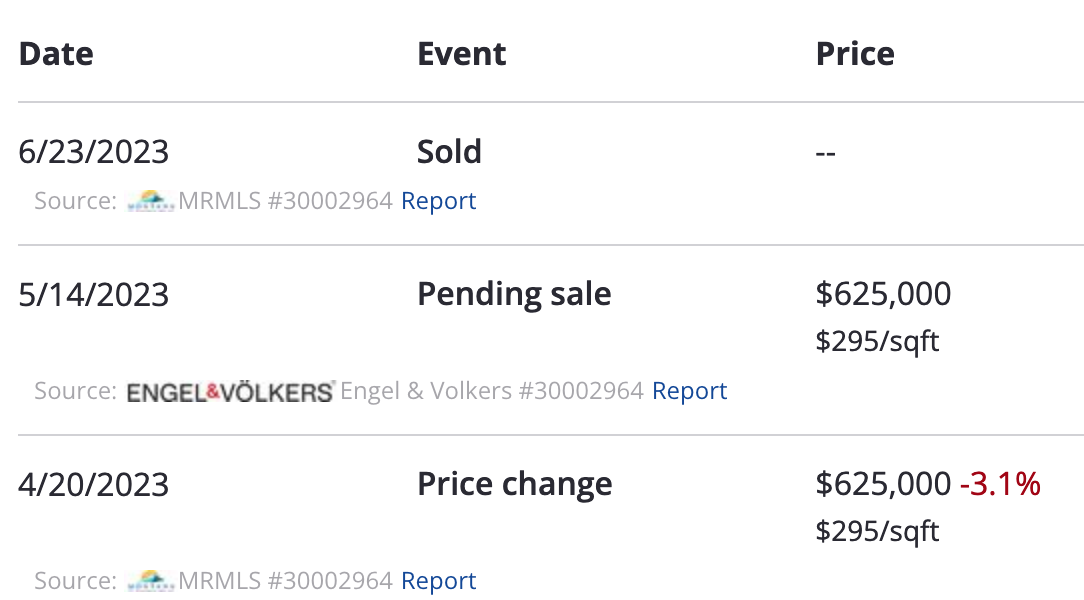

For example, if you were looking on Zillow at a house that is located in one of the states that allows disclosure, you’d see the sales price of that home. However, if you look on the same website or any other listing website in a state like Montana that does not disclose sale prices, you’d see something like this:

So you’d know the house was listed at $625K when it went under contract, and you’d know it sold on June 23rd but you would have no idea what it sold for. It could have been more, less or even the same as the most recent listing price.

Wait, what? What happens to the sales prices?

When a home sells in Montana, the sale price is disclosed to local government officials for the purpose of property tax valuations. That information goes to the county clerk, the Department of Revenue and the county recorder, but those entities must keep the information confidential.

When a home sells in Montana, the sale price is disclosed to local government officials for the purpose of property tax valuations. That information goes to the county clerk, the Department of Revenue and the county recorder, but those entities must keep the information confidential.

At the same time, the data on sale price, method of payment and any concessions is also submitted by the real estate professionals to the local Multiple Listing Services (MLS) application. MLS is used by real estate agents, brokers and appraisers to manage real estate listings and associated data. So if you are a member of that service, you would be able to access the most recent as well as any historical sales prices. This is the tool real estate agents use to provide CMAs (Comparable Market Analysis) which tell both sellers and buyers what the market price of a home might be. It is also the method appraisers use to provide appraisal information.

So why, you might ask, would a state not allow access to sale prices? The Montana Department of Revenue indicates the reason is two-fold. First, the state of Montana’s legislature has determined an individual’s right to privacy of data wins out over the merits of public disclosure. Second, there was concern that the value of the MLS and of the real estate industry would be diminished if the data was made public. While many may disagree with this assessment, at the moment, this is where the sharing of sale price data in Montana remains.

A follow-up question may be, then how does a home owner find out what their home is worth? Or what do they do when they receive their tax assessment and need to know if their valuation is correct? Their options are:

- Compare their property and assessment to similar properties by looking up the tax valuations on the free public site, Montana Cadastral. This system does not provide sales prices, but does allow one to look up tax assessments. So it might be helpful for tax questions.

- Visit the local Department of Revenue office and sign a confidentiality agreement which would allow access to the confidential comparable sales data that was used to value their property (but only the sales data for the homes used for the valuation will be provided, not access to all data).

- Hire a professional appraiser for a fee to evaluate the property.

- Call your real estate professional for assistance.

Bottom line is that finding out the latest sales price for your own home or any other home in Kalispell is not as simple as looking it up online.

If you need assistance with any real estate question in Flathead County/Valley, feel free to contact me at 406-270-3667 or via email at kat@thehousekat.com. I’m happy to assist!