Info for Sellers: Pricing

Billy Buyer is looking for a new home. He has been pre-approved for a $360K purchase. He has already expressed his desire to not even look at anything above his affordability level. Therefore, we’ve added just a bit of room to the price to allow for negotiating. We will only be viewing those homes at or below a $375K limit.

Unfortunately, your house is priced at $410K, which is way above his $375K cap. Your price is also about $50K above the market value. Only you and your agent know why you priced it so high, but I do know your home would be PERFECT for Billy. But it’s definitely overpriced so Billy won’t see it, and therefore won’t buy it.

Not pricing a home properly for sale can be the biggest roadblock to selling your home quickly.

The normal process in determining the asking price is to have your real estate agent develop a comparable market analysis for your home. Your agent will review comparable homes that have sold in your area recently. He will also review those that are under contract and those that have not sold. Using that information, you will be able to determine a range of what the market might pay for your home. Then you can determine the exact listing price. Pricing right around market value is the best way to get lots of buyers through your door, and to get the home sold quickly.

Reasons for overpricing

Some sellers want to put their home on the market for significantly more than the market will spend for various reasons. Perhaps they have put a lot of money into renovations and they’d like to recover that money, Maybe they need a certain amount in order to purchase their next home. Whatever the reason, pricing your home way above the market value will not get you the price you want. In fact, it may do the opposite.

What happens if you overprice

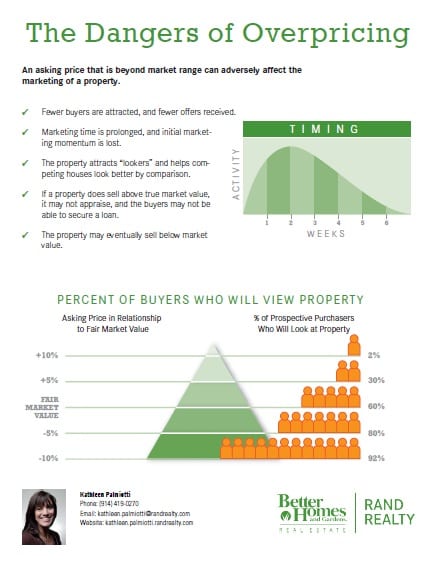

If you overprice, it usually takes longer to sell your home. While you wait, you continue to spend money on mortgage and taxes and maintenance that you would not need to spend if you could sell quickly. You may also wind up selling it for less than market value if the home remains on the market for a long time. As can be seen in the first graphic above, the longer a home is on the market, the fewer interested buyers come to see the home. And of course if they aren’t coming to see the home, they won’t be purchasing it!

Also, what you might be doing by overpricing your home is you just might be helping other homes on the market sell. When buyers DO actually get inside your home and see that it’s in the same condition as another home in the neighborhood that is priced $30K less, chances are good that the buyer will pursue the other home. Your asking price makes the other home look like a bargain.

In addition, as can be seen in the second graphic, the majority of buyers will make appointments to see homes that are at or below market value (which is NOT a recommendation for pricing under market value). Only 2% will even look at a home that is obviously priced 10% or more over market value. Again, if buyers are not walking through your door, they won’t be buying your home.

Pricing your home too low can also backfire. Some sellers do this because they believe a lower price could generate multiple offers. They want to spark a bidding war that may get the price up over the market range. More likely, you will wind up getting less for the home than you would have had you priced at market range, or you may get one offer right at your asking price. You might also have potential buyers that wonder what is wrong with the home (“why is it priced so low?”) and they won’t want to take a chance on it.

Pricing your home is not an exact science, but can be done in a logical manner with an excellent real estate agent’s comparable market analysis.

If you are ready to sell your home in the Monroe NY area, or surrounding towns, I’m available to assist you set the price correctly! Let’s get it sold!