What is a seller’s concession?

I’ve had several buyer clients lately who were informed by their mortgage professional that their pre-approval included a seller’s concession to pay part of their closing costs. There was quite a bit of confusion as to what that really meant. For example, does a concession impact the sales price? Does it impact the appraisal price? When does seller concession get negotiated? Does the seller actually give the buyer cash at closing? Does the seller actually have to agree, or is this just a mortgage company agreement? Can the cash be used for fixing the home up after closing? How does seller concession really work?

Here were my answers.

What is a seller’s concession??

In a nutshell, this is a way for the buyer to include part or all of his closing costs in his mortgage. That’s it!

Is there a maximum seller concession allowed?

Yes.

Each bank or mortgage company may have different rules on what % of purchase price can be used as a concession, and a buyer should check with their mortgage expert on the specific amount they can utilize. In addition, the ability of a buyer to pay back the mortgage may impact the amount allowable for concession.

As of November 6, 2013, USDA mortgages allow seller concessions with no maximum on the amount of closing costs that can be included (although it would be dependent upon buyer’s ability to repay). FHA allows up to 6% in seller concessions. For conventional loans, the percentage allowed differs, but can be somewhere around 3%.

Can you use the seller concession for something other than closing costs, i.e., house upgrades after closing?

No, the concession must be applied to costs incurred at the closing. Sellers do not actually give cash to the buyers; the “money” is on paper only and is a way to include closing costs in the buyer’s mortgage.

Does the seller have to agree to the concession, and when does that conversation take place?

Yes. The discussion around concession must take place as part of the initial offer negotiation, as it impacts the total amount offered and raises potential appraisal value issues.

How would concession be negotiated?

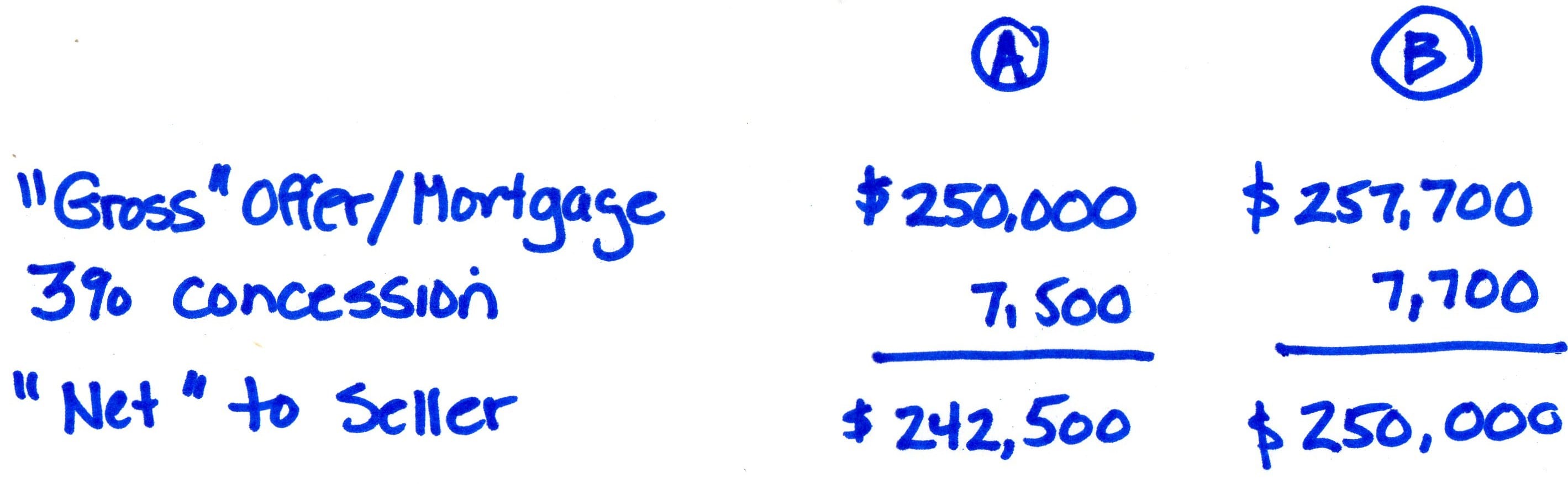

Let’s say a home is offered for $250K (option A), and the buyer wants to offer that amount but they are also allowed a 3% concession. They could offer the seller $250K, but ask the seller to provide a 3% concession back of $7,500, which means the net to the seller would be $242.5K ($250K minus $7500 = $242,500). The seller would have to agree to the “net” amount in order for that deal to work. The mortgage the buyer would pay back would be $250K.

Let’s say a home is offered for $250K (option A), and the buyer wants to offer that amount but they are also allowed a 3% concession. They could offer the seller $250K, but ask the seller to provide a 3% concession back of $7,500, which means the net to the seller would be $242.5K ($250K minus $7500 = $242,500). The seller would have to agree to the “net” amount in order for that deal to work. The mortgage the buyer would pay back would be $250K.

Another way the offer could be placed (option B) would be to make the “gross” offer $257,700. Then you would subtract a ~3% concession of $7,700. This would bring the “net” offer to the seller to $250K . Again, the mortgage to be paid back would be the full $257,700.

In both cases, the buyer is asking for 3% in seller concessions. The seller does not have to agree to any concessions at all, so getting mortgage “approval” for concessions is different than actually getting a seller to agree. Both are necessary.

Since it’s not “real” money, what difference does it make what the top price is?

It might not be real money, but the “gross” price is what the house must appraise at in order for the buyer to get their full mortgage including the concession. In the above example, option B might be a bit tricky. If the market value of the house is $250K, but the gross offer is $257.7K, and the mortgage company appraises the house at $250K, the bank will not give a mortgage based on the higher price. This is probably worth another blog at some future point, but selecting the “gross” or mortgage amount when including a concession needs to be carefully analyzed during the offer process.

I hope this answers the question,

What exactly is a seller concession?

Excellent and timely info, Kathleen! Thank you!

Kathleen

________________________________

Thanks! Is it timely because someone in your family is buying or selling? If you have any questions, feel free to ask!

🙂